“2019 was a stellar year for equity markets and a stark reminder that bad macro is not equal to bad markets, thanks to central bank activism" explains Jérôme Haegeli, group chief economist at Swiss Re. "This being said, we expect the global economy to cool further next year with trade uncertainties remaining the No. 1 risk."

"Our view of sluggish global growth and subdued inflation remains fully intact, and our GDP growth and interest rate projections unchanged from the prior month, though we have revised up the 2019 CPI projection in China, to 2.8 per cent.

"We expect monetary policy to remain accommodative given weakening economic momentum."

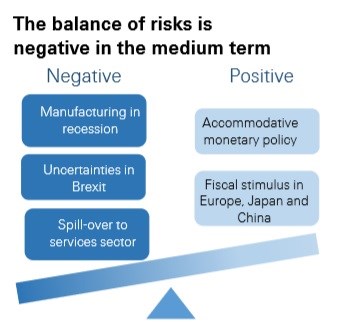

Manufacturing contraction finding a bottom? Recent manufacturing purchasing managers indices (PMIs) suggest that the global manufacturing segment's decline may be stabilising, though there's no clear turn upward in the cycle yet.

By region, PMIs in a number of Asian markets, including China, tentatively rebounded into expansionary territory in November.

In Europe, the segment remains deep in recession, but key countries' indices climbed a bit closer to the 50-mark that denotes stable activity.

However, in the US, the Institute of Supply Management index was still weak for the month. Meanwhile, services indices remain relatively more resilient.

All in, this supports our baseline view of a continued deceleration in growth in major markets in 2020, but no recession.

US-China trade détente holds for now, but key dates ahead: Negotiators from both countries continue working on a 'Phase one' trade deal, though no firm agreement or even a place and time for a signing have been announced yet.

The next set of US tariffs on Chinese imports is set to go into effect on December 15th.

Meanwhile, the Trump administration has formally proposed new tariffs on French goods in retaliation for the recently enacted French digital tax law, and threatened resumption of steel tariffs on Brazil and Argentina, keeping alive trade tensions beyond China.

Trade war thus remains a key macro risk.

Brexit election: We expect the election on 12 December to break the deadlock regarding the ratification of the Withdrawal Agreement if the Conservative Party wins a majority, or else to lead to a second referendum.

The unwinding of no-deal risks this autumn has given support to the Pound Sterling, which appreciated by more than 10 per cent against both the USD and the EUR since the summer trough, leading to likely lower import price inflation going into 2020.

(Geo)political disorder on the rise: Long running protests in Hong Kong continue; a number of hot spots have cropped up in Latin America, for example with riots in Chile, and unrest in several other countries in the region; demonstrations have further arisen in Lebanon, Iraq, Sudan and Algeria, a possible harbinger of a second wave of Arab Spring.

Climate protests have recently taken place the world over. This more general social and political tension outside of the trade sphere, particularly as driven by populism, inequality, and worries around climate change, could have important medium-to-long term growth, inflation and distributional implications.

Economic momentum is softening.

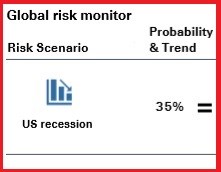

External headwinds have already pushed the manufacturing segment into a contraction, and forward-looking capex indicators remain soft.

Although key historical recession triggers are not flashing red, the risk of the US economy entering recession in 2020 is relatively elevated at 35 per cent.

Key to watch: Financial conditions, yield curve, trade negotiations, leading indicators.

US-China tensions continue to ebb and flow. Despite a possible 'phase one' deal in the next few months, we expect no meaningful resolution anytime soon.

The WTO ruling on Airbus may complicate US-EU relations; same with French (and other countries' potentially upcoming) digital tax laws.

Higher auto sector tariffs pose a key risk.

Key to watch: US-China trade talks, implementation of announced US-China tariffs in mid-Dec; Trump's decision on the auto sector and digital tax laws; USMCA ratification.

Monetary policy normalisation has made a U-turn toward easing in 2019, reducing but not eliminating the risk of a policy error that would lead to an excessive tightening of financial conditions.

By contrast, longer-term risks associated with prolonged monetary expansion are on the rise.

Key to watch: 19 Dec: BoE meeting, 23 Jan: ECB meeting, 29 Jan: Fed meeting.

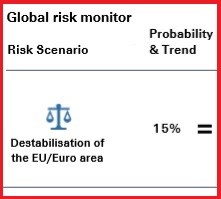

The risk of a disorderly Brexit has declined significantly.

Nevertheless, several conflict areas within the EU remain, including migration policy, national budgets and the rule of law.

Other unresolved issues, such as fragmented financial markets, fragile banking sectors and elevated debt burdens, could surface again in the next downturn.

Key to watch: Italian budget discussions, Brexit developments, ECB/EU Commission agenda under new leadership.

Inflation has remained sluggish despite low or decreasing unemployment, accelerating wage growth, and strength in the services segment.

With central banks back in easing mode, inflation could increase to above target levels. Slowing growth, however, should dampen the risk.

Inflation risk is higher in the US compared to Europe and China.

Key to watch: Oil prices, 20 Dec: US PCE, 7 Jan: Eurozone HICP, 14 Jan: US CPI.

The risk of a debt-driven hard-landing of the Chinese economy has stabilised as a result of earlier strong government efforts to deleverage the corporate sector and better manage shadow banking activities.

Further monetary easing is expected to be limited taking into consideration of rising inflationary pressure.

Key to watch: US-China trade talks and other dispute issues, current account deficit, renminbi depreciation, 10-year US-China yield spread Emerging market contagion

Many emerging market central banks have shifted towards easing-bias. More room for easing measures lowers growth risks for emerging markets.

In an adverse scenario, external financing dries up and an investor panic could lead to an indiscriminate withdrawal of funds from EMs.

Key to watch: Sudden USD strengthening, higher DM sovereign bond yields.

Stronger growth (than baseline) could come from a medium-term resolution of the US-China trade disputes and tariff roll-back, faster decline in unemployment / stronger wage growth in the Euro area and the US, larger than expected fiscal stimulus in Europe and China, or a less damaging growth impact from Brexit.

Key to watch: Strong credit impulse, Brexit negotiations, real interest rates.

The labour market remains tight, with unemployment at 3.5 per cent in November.

Consumer spending expected to be resilient, though downshifting in pace compared to 2019.

Manufacturing remains in recession, but a few other business-side indicators appear more positive, suggesting a stabilisation in capex ahead.

The downturn in the manufacturing sector appears to be bottoming out.

However, the Purchasing Managers Index (PMI) for the sector remains deeply in contraction territory.

While the services PMI weakened in November, the sector remains more resilient.

We revised down headline CPI as inflationary pressures have weakened more than expected in H2, while GBP appreciated.

The growth outlook remains unchanged. Survey indicators slipped into recessionary territory in Q4, confirming our view of continuing economic weakness.

Q3 GDP was in line with expectations, up 1 per cent SAAR.

We foresee a contraction in Q4 due to the October VAT tax increase. Retail sales contracted by 14.4% mom in October.

PM Abe has since announced a Yen 13trn fiscal package, which should support growth in 2020 and 2021 and presents upside potential to our growth forecast.

We revised up 2019 CPI to 2.8 per cent y-o-y from 2.5 per cent to reflect higher than expected pork prices.

Both official and Markit manufacturing PMIs rebounded tentatively to expansionary territory in November although PPI remained negative.

PBoC lowered the OMO rates indicating a persistent accommodative monetary stance despite rising inflationary pressures.