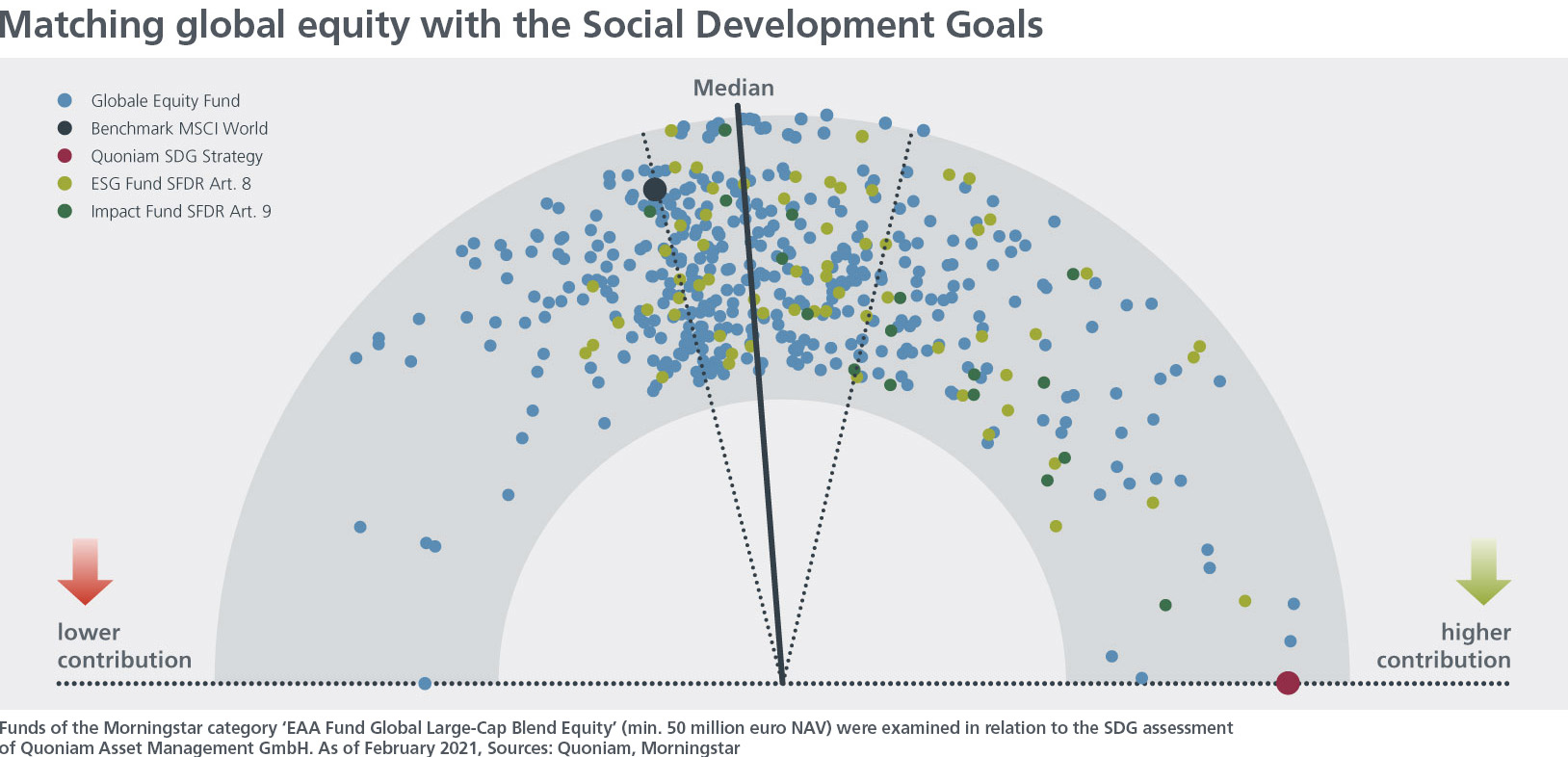

Our new investment strategy offers institutional investors participation in the global equity markets with a focus on companies that make an above-average contribution to achieving at least one of the 17 UN Sustainable Development Goals (SDGs).

The UN SDGs provide a transparent framework for structuring investments in terms of their positive contribution to society. Investors who shift their portfolios to an SDG-based approach are helping to shape the future of sustainable investing.

At Quoniam, our goal is to offer a transparent and understandable SDG investment approach for global equities. In doing so, we aim to go beyond simple exclusion lists. Our strategy combines data-based SDG assessments with diversified multi-factor forecasts. Our long-term oriented investors benefit from a transparent, sustainable equity portfolio with active return potential.

The investment concept focusses on the integration of the SDGs. Controversial business practices as well as companies that seriously obstruct one of the SDGs are not considered in the investment universe.

Using information on products, patents, business processes, environmental costs, management and controversies, we increase the SDG impact of the portfolio as part of bottom-up stock selection. Our SDG and alpha forecasts are considered at the same time, set in relation to each other and mapped in the portfolio using our well-established optimisation process.

As part of our cooperation with other firms within the Union Investment Group, we exchange views with companies on specific SDG issues.

As a quantitative asset manager, we know how to turn vast amounts of data into useful information and how to adapt it to customers’ preferences.

Initiatives from the UN to make the SDGs more measurable and regulatory pushes such as the EU taxonomy are creating a growing amount of highly relevant information. Our research team is continuously exploring new data sources to ensure that the strategy continues to include the widest possible range of relevant sustainability aspects.

We offer our clients transparent, individual sustainability reports on ESG ratings, environmental indicators and SDGs.

"At Quoniam, our goal is to provide a transparent and understandable

SDG investment approach for global equities."

Help to shape the future: Investors can help shape sustainable investing by shifting their portfolios to SDG-based approaches.

Clear and understandable: We offer a comprehensible SDG approach for global equities with transparent reporting.

Data experts: As a quantitative asset manager, we are experienced in selecting appropriate data, aligned with the individual needs of our clients.

Alpha plus sustainability: We combine our proven multi-factor alpha forecasts with carefully selected SDG data.

For more information please visit our website or contact us.