@Pixabay.

@Pixabay.

Insurance companies can benefit from investments into Insurance-Linked Securities (ILS) in two broad ways: (1) by adding diversifying exposures to their own insurance risk profile (which may have capital benefits) and (2) by providing an uncorrelated asset income stream. ILS are financial instruments that provide investors with a return profile that's linked to the performance of an underlying (re)insurance contract. The ILS Market can provide investors with attractive expected returns with low volatility and very low correlation to other asset classes.

ILS offer financial protection to (re)insurance companies, corporations, governments, and other organisations from severe natural catastrophes and, to a lesser extent, other insurance risks such as cyber events. In recent years, dynamics within traditional risk transfer markets have led to ILS being increasingly relied upon as a source of capital for the world’s (re)insurers and the ILS market has grown consistently as a result.

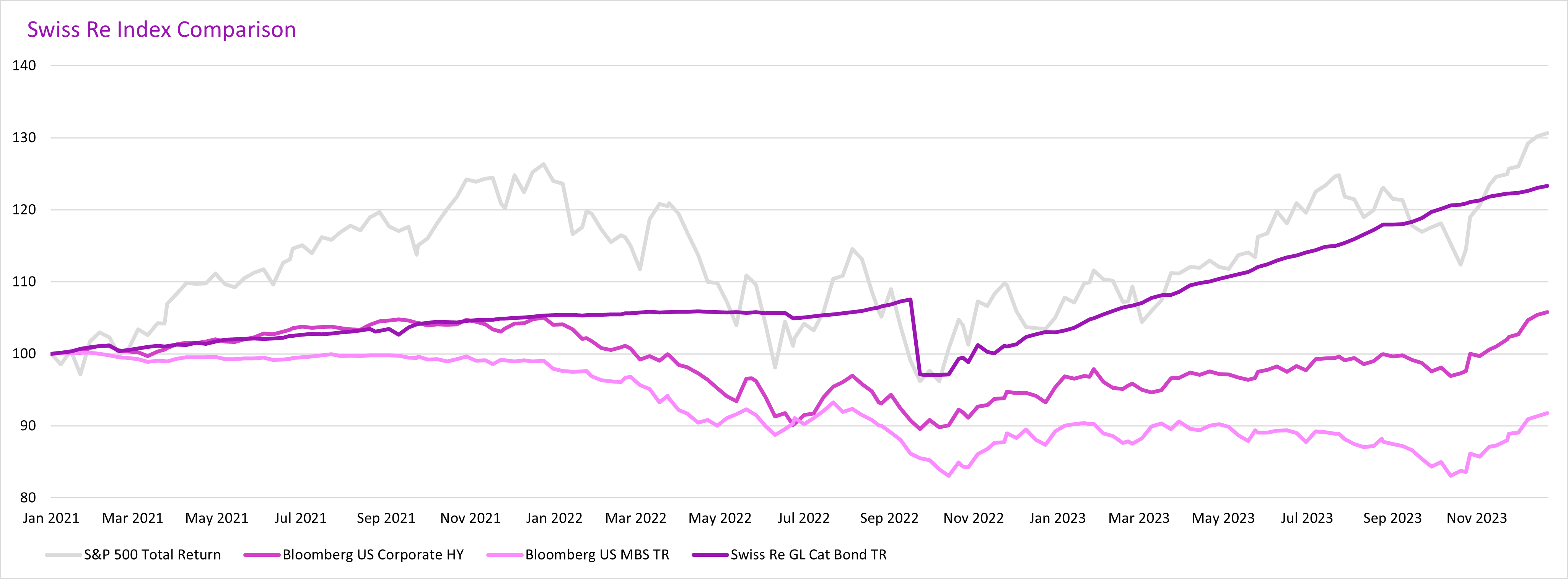

Investors in ILS can receive an alternative source of attractive returns. Over the past three years, catastrophe bonds (cat bonds) as a sub-asset class of ILS have (1) performed in line with equities and outperformed fixed income indices1, (2) proven to be resilient during broader financial downturns and (3) been rapid to rebound from negative periods. The asset class return characteristics are differentiated from other asset classes because their returns are driven by factors which are distinct from the economic and financial phenomena which drive more traditional markets. Swiss Re Global Cat Bond Total Return Index posted a calendar year return of 19.69% for YE 2023. This is the highest one-year return for the index since 2002.

Source: Swiss Re Capital Markets and Bloomberg LP as of December 31, 2023

Note: Swiss Re Global Cat Bond TR (SRGLTRR Index), Bloomberg US Corporate HY (LF98TRUU Index), S&P 500 TR (SPXT index), Bloomberg US MBS TR (LUMSTRUU Index). Swiss Re Cat Bond Indices are based on indicative pricing

Another interesting feature of ILS investments is their resilience to inflation. During inflationary environments, the insured values of (re)insurance companies rises with property values and the cost of construction materials. This increases ILS sponsors’ demand for risk transfer, including their demand for alternative sources of risk-capital such as ILS and cat bonds. This increased demand can lead to increased spreads and therefore increased expected returns for investors.

Cat Bonds are fixed income instruments transferring primarily natural catastrophe risk to capital markets. For the sponsor, cat bond structures function like multi-year reinsurance contracts. For the investor, they function like floating rate notes with collateral income and fixed coupon payments contributing to their overall yield. Additionally, cat bonds’ special purpose vehicle structures benefit sponsors and investors alike by removing counterparty risk, notably sheltering investors from risk associated with a sponsor’s bankruptcy.

In addition to the uncorrelated asset class returns that ILS offer, tapping into the global natural catastrophe reinsurance market may add diversification to the underwriting profile of primary insurers. Insurance companies traditionally specialise regionally, potentially leading to undesirable risk aggregation. Accessing a well-diversified global book of business could increase efficiency of capital deployed to peak natural catastrophe risks that typically trade at the highest margins in the reinsurance market and open the opportunity to profit from new sources of revenues alongside Swiss Re without building their own operations across regions.

We consider 2024 to be a very attractive time to invest in the market as spread levels are close to historical highs with a yield in the cat bond market around 13%2. Continued strong demand for reinsurance protection and therefore large volumes of cat bond new issuance are expected to allow capital to be invested at attractive spreads.