@SwissRe.

@SwissRe.

An effective COVID-19 vaccine is good news for the global economic outlook. Yet the structural damage from the COVID-19 shock, in the form of higher debt and inequality, alongside weak economic resilience pre-COVID-19, are brakes on the longer-term outlook. A policy reset is needed.

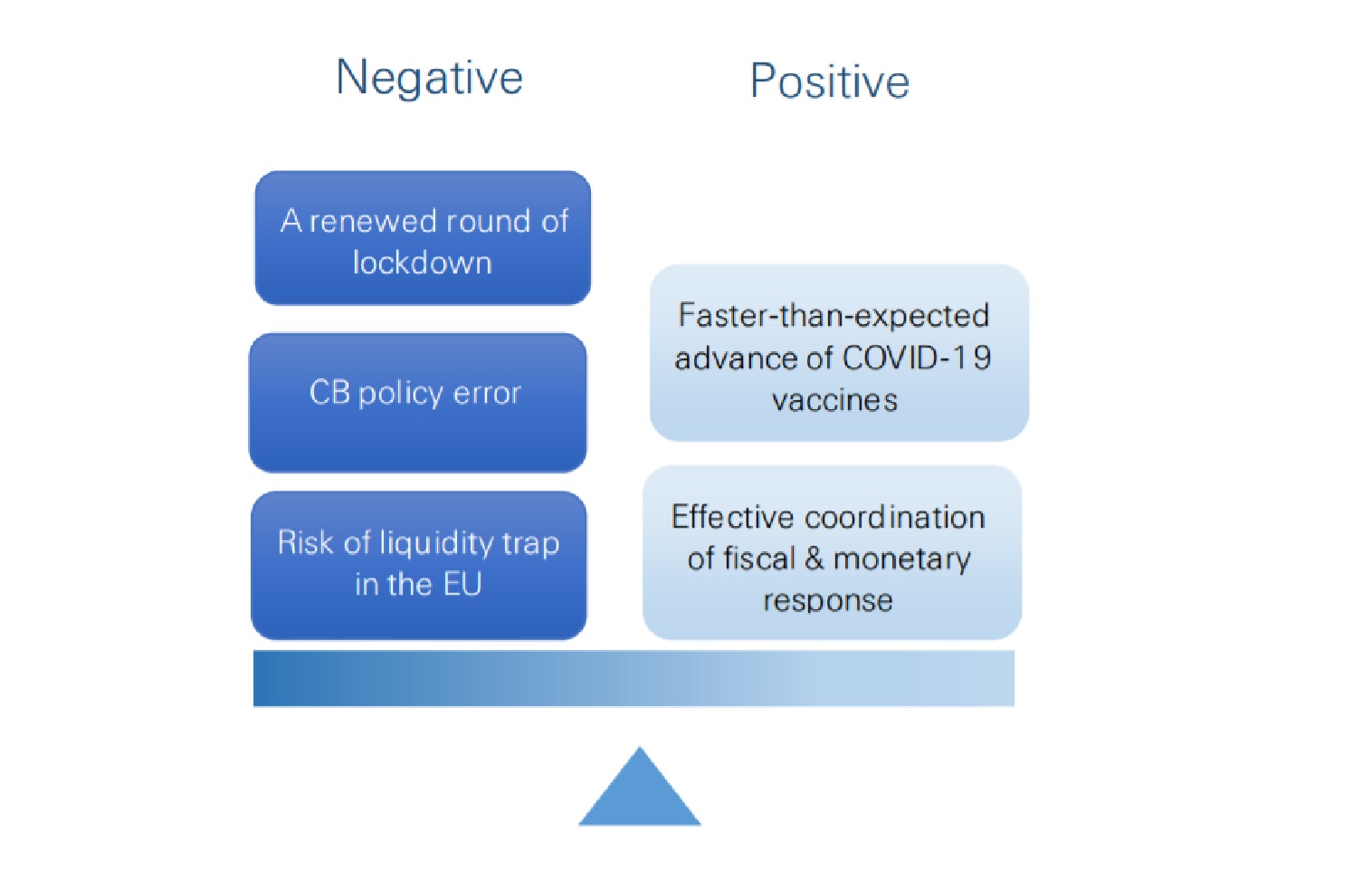

In light of the sooner-than-expected announcement of what appears to be an effective vaccine against COVID-19, we view the economic risk outlook as roughly balanced.

As questions around effectiveness, duration of immunity, its resilience against new strains of the virus, logistical hurdles, timeline for rollout etc remain, mobility restrictions will likely remain in place in heavily virus-affected regions.

As such, we expect a double-dip contraction in the Euro area in Q4. We also continue to expect a protracted recovery and have revised down our forecasts of 2021 GDP growth in the US and EU to 3.5%/4.0% respectively.

While Joe Biden is effectively the new US president-elect, the US Congress appears to be split with Democrats keeping the House of Representatives while the Senate is likely to be balanced or marginally Republican.

The decreasing political uncertainty is good news for the economy, though a split Congress implies that fiscal stimulus in excess of USD 1trillion appears now off the table.

Near-term recession risk remains fairly low, as the economy is firmly on its recovery path and Q3 GDP expanded 4.9% y-o-y.

In the recently launched 14th Five Year Plan, China put technology and innovation as the centrepiece for sustainable growth, and the "dual circulation" strategy highlights the role of domestic demand in boosting growth.

New steps will also be taken to deepen reforms and open up the economy. Uncertainties over US-China relations after the US election, weak global demand and fragile business sentiment are the major headwinds

A Biden presidency will not change the US stance against China in essence.

Even with a Democrat Senate, tariffs are likely to remain in place and further trade discussions could take place in exchange for concessions from China around core issues including intellectual property and industrial policy.

The trends of de-globalisation and formation of parallel supply chains are expected to continue in the medium term.

A medium-term resolution of the US-China trade disputes and tariff roll-back would also be an upside risk.

Even with a potential vaccine now becoming more realistic to be rolled out in 2021, continued stimulus is required to sustain economic growth while ensuring conducive financial conditions.

In the US, we continue to expect another fiscal package in 2021 of roughly USD 0.5-1 trillion.

As for central banks, the Fed and the ECB will likely continue to pursue their ultra-loose monetary policies. On the latter, the ECB should announce further stimulus measures through additional quantitative easing in the December meeting.

Due to the vaccine potential and expect continued stimulus, we have revised lower our likelihood of a global credit crisis, but increased strong growth and inflation risks somewhat.

Strong credit mitigation measures deployed have helped to contain the risk of downgrades and defaults in the investment grade credit market.

However, corporates in certain industries (e.g. SMEs, travel sector) remain under pressure. It may still be necessary in some cases to set up bad banks to absorb high risk assets and to make use of equity injection programmes to lower risks.

Headline CPI diverged across major economies with surprising strength in the US and negative inflation in the Euro area (to some extent driven by the German VAT cut).

Still, short-term inflation risks are low given weakened demand due to COVID-19, which outweighed the supply shock.

However, medium-term inflation risks have increased given the unprecedented fiscal stimulus and potential monetisation of debt.

The Fed's change to average inflation targeting implies slower policy reactions to rising inflation, which increases inflation risks.

The additional focus on broad-based and inclusive employment risks overburdening the Fed.

Increasing "financial repression" and potentially even eventual debt monetisation to accommodate the massive fiscal stimulus could increase longer-term risks associated with a loss in central bank credibility.