@SwissRe.

@SwissRe.

The recession will be sharper and deeper than anything we have ever seen before in our lifetime; at the same time, it could also be one of the shortest in history.

This being said, the recovery will be protracted with big paradigm shifts in the making and lower global economic output of around USD 12trn by end 2021.

We expect a global recession in 2020 with GDP contracted by 3.8 per cent. The recovery will likely to be protracted despite massive fiscal stimulus measures.

Global long-term yields will remain at very low level. The risk of a global credit crisis along others are on the rise, in particular Emerging Markets (EM will be more vulnerable to ad-hoc shocks.

We are more positive for the US relative to Europe and see China leading the way.

We expect the global recession to be the deepest one in our lifetime and we won't be back to normal any time soon.

Global GDP is projected to contract 3.8 per cent, more than double the -1.8 per cent drop in 2009.

Economic activities are likely to remain severely constrained throughout 2Q, even assuming new infections in Europe and the US to peak in May (see chart a below).

We expect the hit to economic activity to be the strongest in 2Q. Sharply rising unemployment and permanent income losses will limit consumption growth and thus weighing on economic growth in 2H and beyond.

While the recession will likely be short, the recovery will be protracted. In addition to extraordinary monetary policy support, massive fiscal stimulus of almost four per cent of global GDP (compared to 1.6 per cent in the GFC) will provide some cushioning in near term.

However, weaker economic resilience (compared to GFC time), impact of pandemic on consumers' behaviour, as well as structural disruption on global supply chain will pose additional pressure to post-COVID-19 recovery.

Interest rate will remain very low as financial repression is on the rise. With surging public debt resulted from cumulating fiscal stimulus, central banks are likely to be active in capping yield increases to accommodate rising debts if needed.

We project US 10-year yields to close at 1.0% at year-end, and yields in Germany and Eurozone will likely remain negative for the foreseeable future.

With immediate systemic risk capped, medium term risks are accumulating. The immediate systemic risk has been significantly reduced due to aggressive credit support by major central banks.

However, concerns over medium-term risks are rising in particular for the risk of US China trade war.

As a result of the COVID19 shock, we expect more differentiated recoveries among emerging market economies.

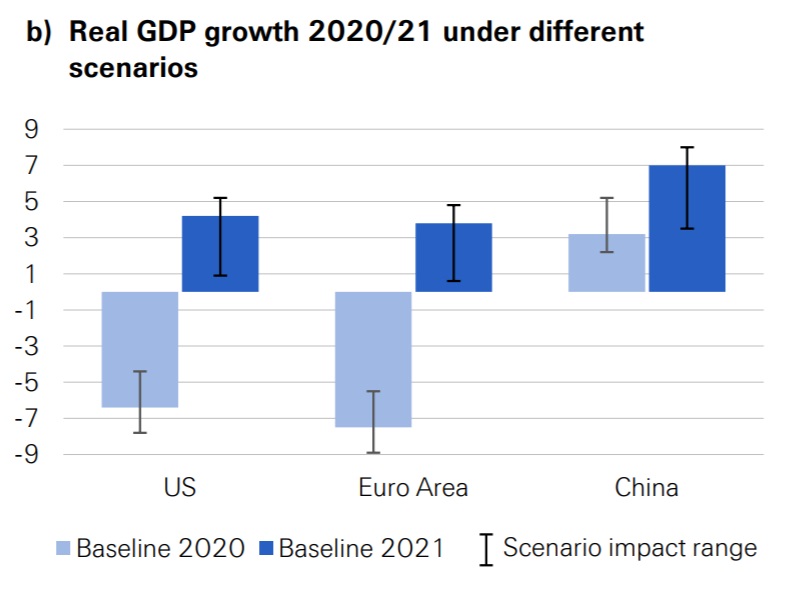

Downside scenarios are more likely than an upside scenario. Scenario thinking is more important than ever amid tremendous uncertainties (see Alternative scenarios and chart b below).

A prolonged recession is more likely than a swift recovery, and the risk of "stagflation" is a key medium-term risk scenario given unprecedented fiscal stimulus and potential debt monetisation.