@SwissRe.

@SwissRe.

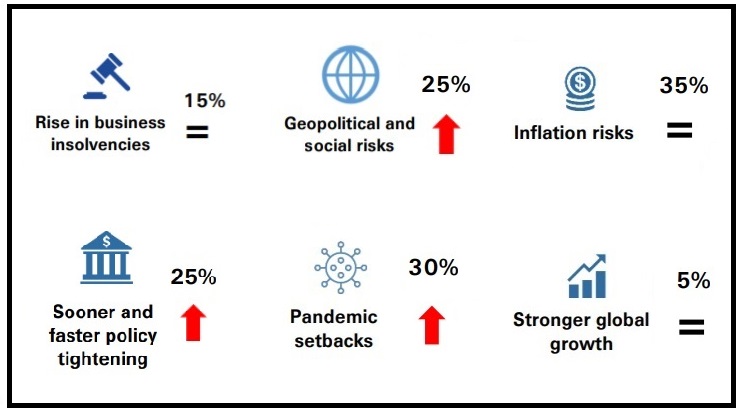

Pandemic risks and supply bottlenecks are refusing to fade, and we believe downside risks have risen.

We expect inflation to be structurally higher as firms reconsider faraway parts of supply chains, and excess demand prevails.

The newest COVID-19 variant, Omicron, is the World Health Organization's fifth variant "of concern", but so far the risk it poses to public health remains unclear.

In Europe, a steep surge in new cases of all variants is prompting a return to mobility restrictions (e.g., Germany) and even lockdowns (e.g., Austria).

The new measures are a setback for economic growth, however, data suggest that the link between economic activity and restrictions is weaker compared to last year, since businesses and consumers are better adapted.

Just under 45% of the global population has received all vaccination doses as prescribed by local protocols, and the pace of vaccinations is moderating.

We forecast inflation to be higher in 2022 than in 2021 especially for the US, the UK, Japan and China.

By our estimation, the surge in inflation during the pandemic has been about twice as steep in advanced than in emerging markets.

Sustained inflationary pressures raise stagflation risks in economies including the US, Brazil, and China, but we do not see a 1970s-style stagflation as our baseline scenario except for Brazil.

Nonetheless, we believe inflation will be structurally higher going forward as lingering disruptions may encourage businesses to re-shore or invest in parallel supply chains.

The reappointment of Powell as chair of the US Federal Reserve (Fed) helps to reduce uncertainty in a cloudy policy outlook.

Downward movements in 10y Treasury yields align with our forecast of 1.4% for 2021. As the Fed shifts to a hawkish tone on inflation, the market is currently pricing three rate hikes for 2022, but we still expect only two.

This earlier-than-expected lift-off is beginning to hurt emerging markets, as their capital inflows have come to a sudden stop this quarter.

For the emerging world, this will likely mean weaker currencies, higher inflation, tighter financial conditions, and slower growth.

We also expect rate hikes in the UK in 2022, but in the Euro area more patience from the ECB is likely, with no rate hikes next year.

Inflation pressures will remain higher for longer. We see inflation in the US peaking in February 2022, and forecast annual 2022 inflation for most markets higher than in 2021.

With policy tightening looming in advanced markets, emerging markets will likely see currency depreciation pressures that will consequently add to inflation.

Central banks have limited ability to resolve this type of supply-driven inflation shock.

Key to watch: Euro area HICP (17 December), US PCE (23 December), US CPI (10 December), OPEC meeting (4 January).

Pandemic-related setbacks are materialising. The surge that began this autumn looks much like the surge of October 2020 – suggesting that the seasonal effect could exacerbate virus spread during the winter.

The swift re-classification of Omicron from a Variant Under Monitoring (November 24th) to a Variant of Concern (November 26th) highlights how quickly a new variant can worsen the public health landscape.

Key to watch: Emergence of more mutations and variants, hospitalisation and death rates, vaccination and booster rollout rates, stringency of restrictions, individual behaviours.

Prolonged price pressures risk triggering a renewed rise in long-term inflation expectations, which could force central banks to tighten monetary policy sooner and faster than we originally expected, resulting in tighter financial conditions.

We see increased risk of policy mistakes from tightening. Fiscal policy support is set to diminish following the massive stimulus of 2020-2021.

Key to watch: Central bank speeches, policy moves, inflation expectations, further fiscal announcements particularly extra spending bills current under negotiation in the US.

The global energy crisis contains a strong geopolitical element (eg, tensions over the Nord Stream II Russia Germany gas pipeline) as governments grapple with energy security and compete for restricted supply.

The US and Europe have warned Russia of sanctions in case of an invasion of Ukraine. Geopolitical tensions between China and Taiwan are also key to monitor.

Key to watch: US-China disputes, Russia-Ukraine tensions, economic sanctions, energy crisis knock-on implications, income distribution data.

Public support measures have prevented an increase in business insolvencies so far, but these could increase as measures end and/or there is a sharp rise in debt servicing costs.

The trend of "zombification" could also lead to a delayed but sustained period of higher insolvencies if support measures are prolonged.

Key to watch: Business bankruptcies, credit spreads, restructuring/default rate news, debt servicing costs (interest rates).

Growth could strengthen if vaccine rollout progresses faster in emerging markets and there is strong demand for booster shots in advanced markets; countries move away from their "Covid-zero" strategies; and/or if the effectiveness of fiscal spending is greater than anticipated.

A resolution to US-China disputes, with a roll-back in tariffs, would also be an accelerator.

Key to watch: Vaccination progress, severity of restrictions, fiscal spending plans, PMIs, consumption, real interest rates, productivity levels.