@SwissRe.

@SwissRe.

Following the strong rebound over the summer, we are now entering a much more subdued recovery phase.

Expect heightened volatility in financial markets due to political risk around the US election.

Our baseline of a protracted global recovery remains unchanged. As economic momentum has started to fade, the global economy will need to rely on continued monetary and fiscal stimulus to avoid a double-dip recession.

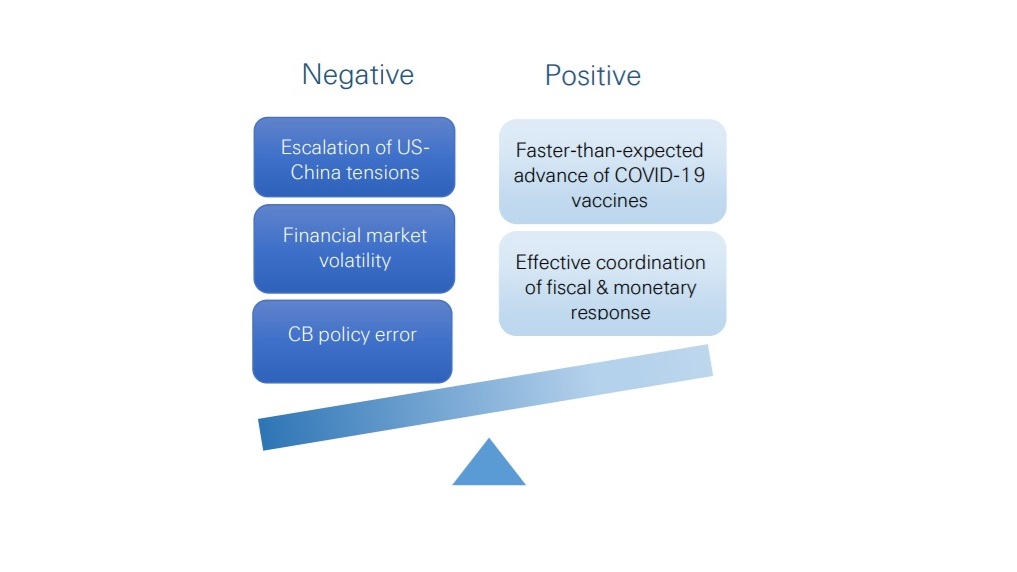

Overall, risks remain tilted to the downside.

Global economic momentum is stalling in Q4 amid rising infections

New COVID-19 infections in major advanced markets have risen considerably over the past month, with both Euro area and UK, surpassing their respective first wave peaks (see Figure. 1).

As a result, governments have reinstated local restrictions and quarantine requirements on travellers from abroad, leading to receding mobility (see Figure. 2).

While US monthly average infections were lower in September than in the previous two months, the recent rise in numbers is underlying our expectations of weaker economic momentum in Q4.

We estimate current GDP shortfalls of G7 countries to range between 6 - 12% (see Figure. 3).

The hit to the economy is less severe in the US but slightly worse in Europe

We revise up our 2020 US real GDP growth forecast to -4.6% (+ 1.8 ppt) on stronger than expected 3Q data.

With monetary stimulus here to stay and the Fed allowing for inflation to run above target, we don’t expect the US 10-year yield to move above 1% through 2022.

Meanwhile, growth momentum in the Euro area is fading with the Services PMI back to contractionary territory in September (at 48.0, Fig. 4), resulting in a slight downward revision to our 2020 GDP growth forecast at -7.8% (-0.3ppt).

The upcoming US presidential elections will define fiscal policy in 2021.

While further fiscal stimulus has become unlikely in the remainder of this year, we foresee a new package to provide support in 2021.

A Democrats win with control of the Senate would likely provide a larger fiscal stimulus and anchor a stronger short-term recovery in the US than a Republican control of the Senate and/or the White House.

With rising tensions about the clarity of election results and the possible transition of power, we expect heightened financial market volatility through the turn of the year.

Brexit talks are moving into the end stage.

The EU has launched legal proceedings against the UK over the Internal Market Bill.

Nevertheless, as the transition period draws to a close, PM Boris Johnson and European Commission President von der Leyen agreed to intensify Brexit talks over the coming weeks.

We see high level talks as a positive signal and continue to expect a skinny deal, potentially by the end of October.

Recent US threats to ban Chinese companies WeChat and TikTok highlight the ongoing tensions between the two countries despite the review of the Phase 1 deal resulting in the commitment from both sides to its fulfilment.

Tensions are likely to remain elevated around technology disputes due to political rhetoric in the US ahead of the presidential election in November. In addition, other non-China issues to watch include digital taxes from Europe and tariffs with Canada.

Key to watch: Bans/barriers on Chinese 5G and tech companies; tariff developments; progress on US-China Phase 1 implementation; digital taxes.

The global recovery is backed by substantial monetary and fiscal policy support.

The strong credit mitigation measures deployed have helped to contain the risk of downgrades and defaults in the investment grade credit market. Yet corporates in certain industries (e.g. SMEs, travel sector) and emerging markets are still under pressure.

It might still be necessary in some cases to set up bad banks to absorb high risk assets and to make use of equity injection programs to lower risks.

Key to watch: Earnings releases, corporate credit spreads, restructuring/ default rates announcements.

The Fed's change to average inflation targeting implies slower policy reactions to rising inflation, which increases inflation risks.

The additional focus on broad-based an inclusive employment risks overburdening the Fed. Increasing "financial repression" and potentially even eventual debt monetisation to accommodate the massive fiscal stimulus could increase longer-term risks associated with a loss in central bank credibility.

Key to watch: 29 Oct: ECB meeting, 4-5 Nov: Fed meeting, 5 Nov: BoE meeting.

Recession risk for China remains stable with a 15% probability as the economy is firmly on its recovery path. Heightened US-China tension, weak global demand and fragile business sentiment are major headwinds.

Nonetheless, strong fiscal support estimated at ~6% of GDP alongside other policy supports, mainly aiming at enhancing domestic growth potential through market-oriented reforms, should help to limit downside risk.

Key to watch: US sanctions and dispute, financial flows, Renminbi FX.

Headline CPI diverged across major economies with surprising strength in US and negative inflation in the Eurozone (to some extent driven by the German VAT cut).

Still, short-term inflation risks are low given weakened demand due to COVID-19, which outweighed the supply shock. However, medium-term inflation risks have increased given the unprecedented fiscal stimulus and potential monetisation of debt.

Key to watch: OPEC+ communication, 16 Oct: Eurozone HICP, 30 Oct: US PCE , 13 Oct

US CPI.

Several conflict areas are present in the EU, including migration policy, national budgets, and the rule of law.

The agreement on the COVID-19 recovery plan and the multiannual financial framework is a significant step for a more sustainable Europe.

The extension of unemployment schemes also mitigates immediate downside risks.

Key to watch: 15 – 16 Oct: European Council meeting, COVID-19 government responses, migration developments, ECB/EU Commission agenda.

Stronger growth (than baseline) could come from a viable vaccine becoming available earlier than expected, together with a swift and coordinated monetary and fiscal response across countries resulting in a faster recovery.

A medium-term resolution of the US-China trade disputes and tariff roll-back would also be an upside risk.

Key to watch: Credit impulse, timing of lock-down end, real interest rates, G20 coordination.