Jason Engelbrecht: These are areas that, if they do take off, will completely change lines of business or the industry as a whole.

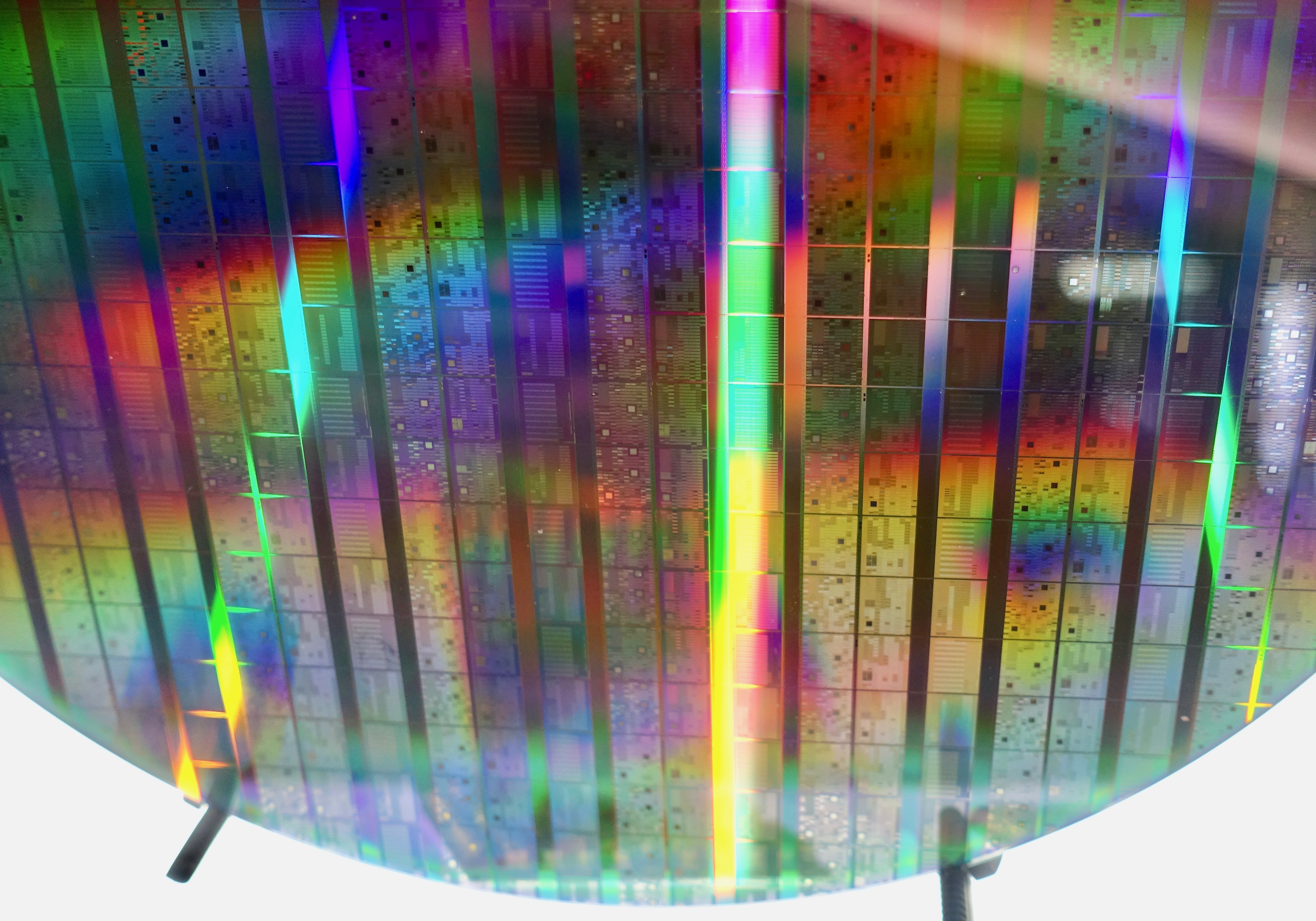

The one that we have highlighted for this year is quantum computing. It’s an area that the company has put a lot of effort into, such as understanding the mathematics, the companies involved, and its feasibility.

"As it matures, quantum computing could provide some

big, practical, and positive benefits."

There are many horizons to quantum computing, but even in the short-term, it has the potential to solve a lot of complicated issues, including in logistics and medicine.

As it matures, quantum computing could provide some big, practical, and positive benefits. Over a 20 to 30-year timespan, it could fundamentally change many different industries.

Jason: Because we operate in the reinsurance space Munich Re has a very long horizon, and we think about the long term.

What we try to understand is what the needs and worries of people are today and in the future.

"Technology allows us to better understand risks and therefore

informs our underwriting decisions."

There are going to be benefits that are felt across everything that we’re working on, but we think that underwriting is where we are going to see the greatest benefit.

Technology allows us to better understand risks and therefore informs our underwriting decisions. The derived benefit is that it will create a better customer experience.

Jason: Technology is very important, and the insurance industry is starting to see this more and more. For example, my background is not in insurance, but in AI machine learning.

The insurance industry appears very similar today to where the banking industry was around 10 years ago.

"It’s vital to stay on top of technology, particularly for

reinsurers, since our time horizon is so long."

Today, many traditional and start-up banks see themselves more as technology firms who just happen to manage capital. You see this happening now within the insurance industry, but to a much lesser degree.

It’s vital to stay on top of technology, particularly for reinsurers, since our time horizon is so long. This allows us to set ourselves up for success in the future.

This requires a financial and strategic commitment to innovation and technology.

Jason: What is important for insurers investing in technology is to have a mixed time horizon and to look at technology across a wide spectrum.

"Investing in innovation means securing long-term growth"

At Munich Re, we believe that investing in innovation means securing long-term growth—we are taking the long-term view.

What you don’t want to do in this industry is just be reactive and only invest in areas when you absolutely have to - that could be a recipe for a long and steady decline.