Insurance Investor and NN IP, brought together a roundtable of insurers and asset allocators to discuss the challenges and advantages of private debt as an asset class.dd

Speakers:

To download the full roundtable click here.

This excerpt shows how contributors are thinking about asset allocations in private debt,

Corrado Pistarino: I’m the CIO at Foresters Friendly Society. Foresters is a UK mutual society. It has a small balance sheet, so we are heavily constrained in our investment strategy, but over the past few years we have oriented our balance sheets towards alternative assets.

When I joined at the end of 2017, the balance sheet was what one would expect from a traditional UK middle-sized insurance company, with a sizeable allocation to gilts, sterling corporate credits and the FTSE index.

Since then, we have changed the asset allocation significantly, broadening our investment universe into new asset classes and geographies. In the liquid space, we have added exposures to high yield and convertibles.

“In the liquid space, we have added exposures to high yield and convertibles.”

We have moved from a domestic approach to a global approach by investing in global or regional share classes hedged back into sterling.

As a result, the liquid portfolio has become more granular and diverse. However, the heavy lifting has been done with respect to the illiquid portion of the investment portfolio because this is where the real value is, I think.

We have a legacy portfolio of UK commercial and residential properties, which we manage directly. We have scaled this down to reduce concentration to the asset class and used these funds to invest into alternatives.

Currency risk is expensive both in terms of economic and solvency capital. It is a big constraint for us. On the other hand we do not want to be solely exposed to the UK economy.

“We have invested in a private debt fund with a European reach, where

the currency exposure is hedged back into Sterling.”

We do recognise the value in diversifying across geographies. For instance, we have invested in a private debt fund with a European reach, where the currency exposure is hedged back into Sterling. Hedging currency risk is obviously easier with debt products than equity products

In terms of alternatives, our exposures include private debt, income-generating properties, infrastructure equities, trade finance and, more recently, commercial real estate equity.

I believe we have succeeded in building a reasonably diversified private-market portfolio, considering the size of Foresters’ balance sheet.

Gerard Bonekamp: I work for Achmea in the investment department. Responsibilities include defining and implementing the asset allocation for the Achmea insurance companies. My focus is on fixed income.

Achmea consists of Health, Property and Casualty and Pensions and Life insurances. For each we have our investment strategy.

“We have been an active investor in the broader area of private investments

for quite a long time.”

For example, in health, the duration of the liabilities is short, and liquidity is important, while in pension and life insurance we have more room for illiquidity and longer maturity investments.

We have been an active investor in the broader area of private investments for quite a long time, resulting in books of Dutch mortgages, government guaranteed and real estate loans etc.

We will continue to work on broadening our asset universe, including mid-cap loans both externally and internally rated.

One of the challenges is how to model new and illiquid asset classes for SII market risk. We work with an internal model. The model determines the risk charges that are key when comparing alternative credit with the other categories.

Marieke Van Kamp: I work at the NN group where we have the investment office which oversees all the investments of the insurance companies in the group.

“We have been invested in private loans for quite a while and over the past years

we have added a focus on below investment grade.”

Within the investment office I am responsible for the alternative investments, real estate, private equity, infrastructure and private loans.

We have been invested in private loans for quite a while and over the past years we have added a focus on below investment grade connected to the investment grade strategies that we already had within our portfolio.

An important focus of ours is the Paris alignment goals, the net zero goals, and how to transition our portfolio towards this - so seeking investment managers and funds who are very conscious of this and actively pursuing these areas.

We have been doing this on the life balance sheet for a very long time and we have multiple insurers within the group that have a smaller balance sheet.

For these groups, these types of assets have also become popular over the past couple of years.

“An important focus of ours is the Paris alignment goals, the net zero goals,

and how to transition our portfolio towards this.”

We try to pool everything so that every business unit no matter how small or large has the ability to access the same portfolio strategy.

Correct risk and Solvency modelling is very important to us, so we need investment and fund managers to give us all the underlying information on a line-by-line basis, including ratings on at least a monthly basis.

This can be a challenge especially with niche opportunities. If we cannot obtain any ratings, for prudency we revert to treating these investments in a way that nears the private equity treatment.

This is one of the reasons that we want to work with managers that are able to provide us ratings and, if they cannot, actively engage with them to develop this.

Marcel Naus: I am a senior portfolio manager at VGZ, one of the leading health insurers in the Netherlands and I look after the internal managed equity portfolios, but am also involved in the new below-investment grade corporate debt search.

“We want to diversify.”

We did an ALM study this year and one of the purposes was to look at how to diversify our sources of return.

Currently, on the one side we have government bonds, triple As and a corporate, which don’t generate that much return and on the other side we have equity, which generates a lot of return at present, but we don’t have anything in between.

We want to diversify and in the ALM study we now have three new asset classes below investment grade corporate debt, which consists of leveraged loans, private debt and trade finance.

This will probably be a core satellite approach with the core consisting of leveraged loans, satellited with private debt.

“ESG has become very important, and we decided to allocate a small part

of our assets to this.”

Another new asset class is emerging market debt hard currency which was a good diversifier. The last additional category was impact investing because ESG has become very important, and we decided to allocate a small part of our assets to this.

One consideration is that because VGZ is a health insurer, we have quite a low duration and the other is that we are a health insurer first and an asset manager second, so it is very important for us to explain to the rest of our organisation what we are investing in.

This is a process, and it takes time to convince others within our organisation with items like below investment grade corporate debt.

We also want to always be in control and to have our organisation geared up for this.

Anand Kwatra: We have a mandate to source many illiquid assets ranging from social housing and local authorities to areas like commercial real estate, infrastructure and more structured assets.

“Sustainability within illiquid assets is very high on our agenda.“

Whilst we are investing in different areas, sustainability within illiquid assets is very high on our agenda.

When considering new investments, we need to go through a process of deciding what a new asset class is and what a new risk is.

It could simply be something like expanding into a new territory. For instance, we have a strategic objective to look at more private credit assets from overseas so we can access a deeper pool, a bigger range of issuers and diversify our credit risks.

Equally on the new assets side, we are looking at more structured investments so we can harness more illiquidity premium.

“We have a strategic objective to look at more private

credit assets from overseas.”

A new venture may also involve accessing exposures which will meet our sustainability objectives (e.g. housing associations with sustainability linked coupons).

Jeev Muthulingam: There are two reasons insurers access private debt. Firstly, it provides diversification from pre-dominantly domestic government, government-related and corporate bonds which are relatively small in terms of exposure to names and sectors.

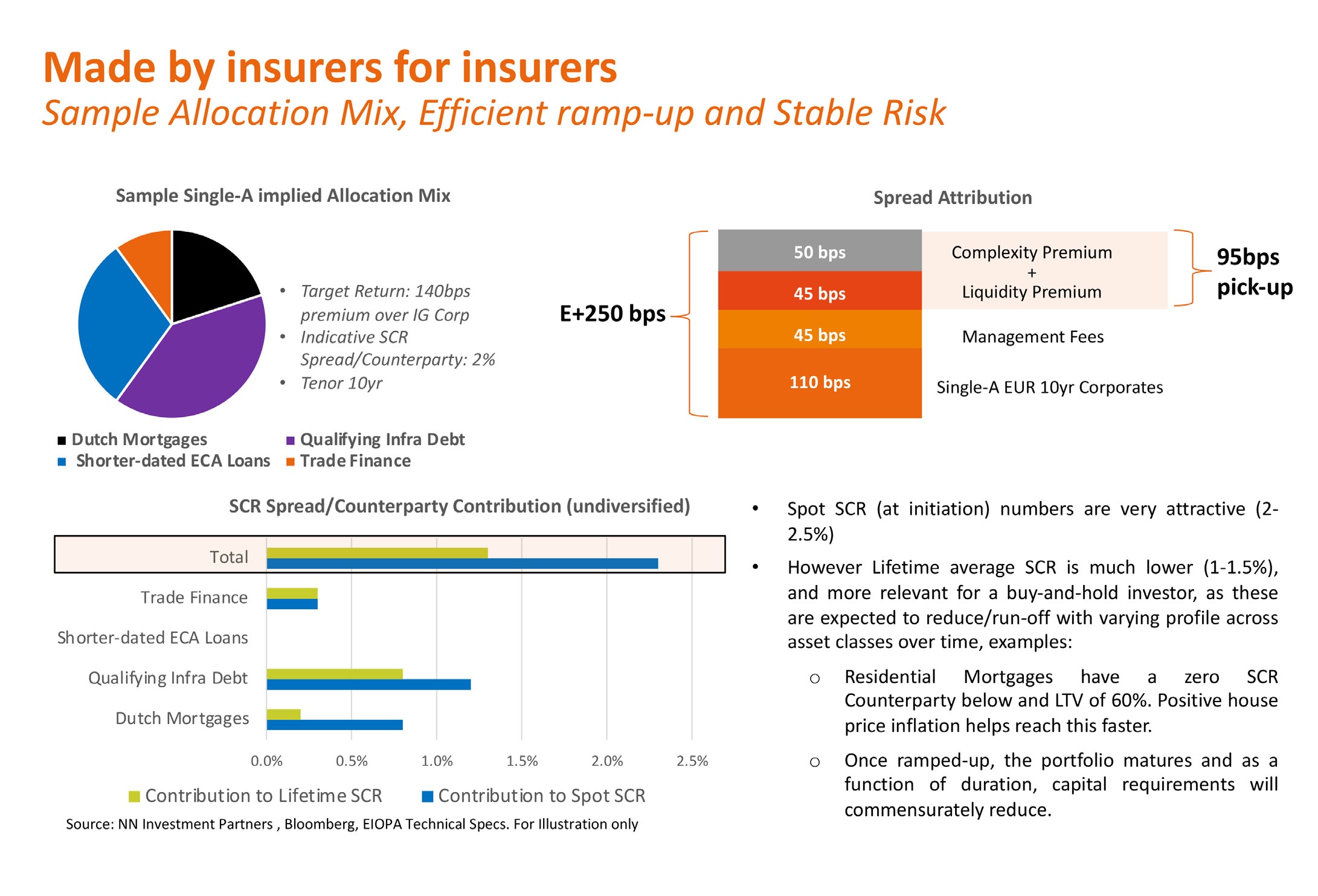

Secondly the significant risk-adjusted spreads or RaRoC (risk adjusted return on capital).

There is a role for insurers to provide access to investment solutions which policyholders cannot directly access themselves given the private nature, scale or complexity of private debt.

“It provides diversification from pre-dominantly domestic government,

government-related and corporate bonds/”

Therefore, it makes sense to add these to an asset mix to attract policyholders into savings solutions out of cash or deposits.

Whilst spreads have generally compressed across all sectors, these have been differentiated across domestic and cross currency markets. Especially considering capital and ESG adjusted metrics, there are still pockets of opportunities in “less travelled areas”.